Why AppLovin Stock Fell 36% This Week--And Might Go to $0

What are the claims? Are they accurate? What does that mean for me?

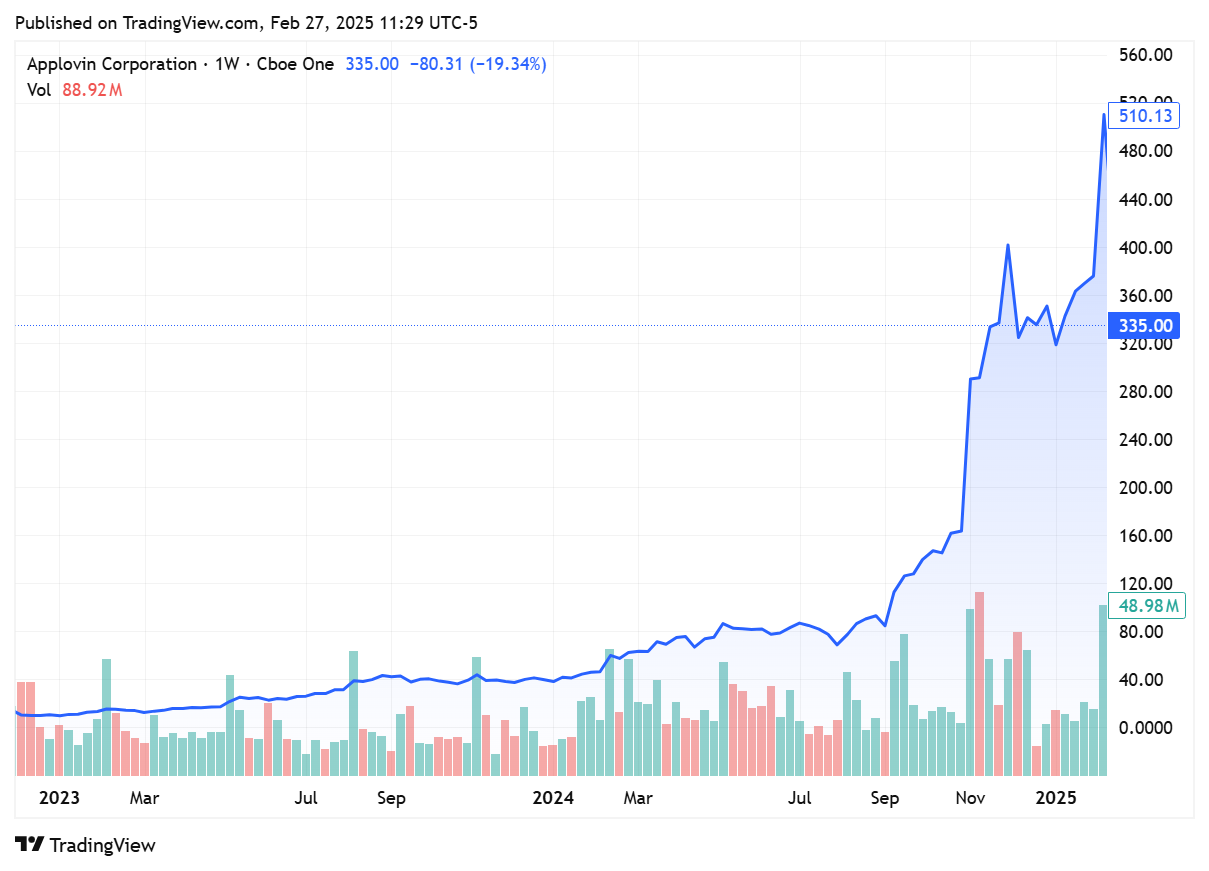

AppLovin’s stock soared 36x in just two years, turning a $12,000 investment into enough to buy a house by 2025.

But now, short sellers1 claim it’s all a fraud—and the house of cards could collapse at any second.

What’s the truth?

If you want to skip to my assessment of claims, click here

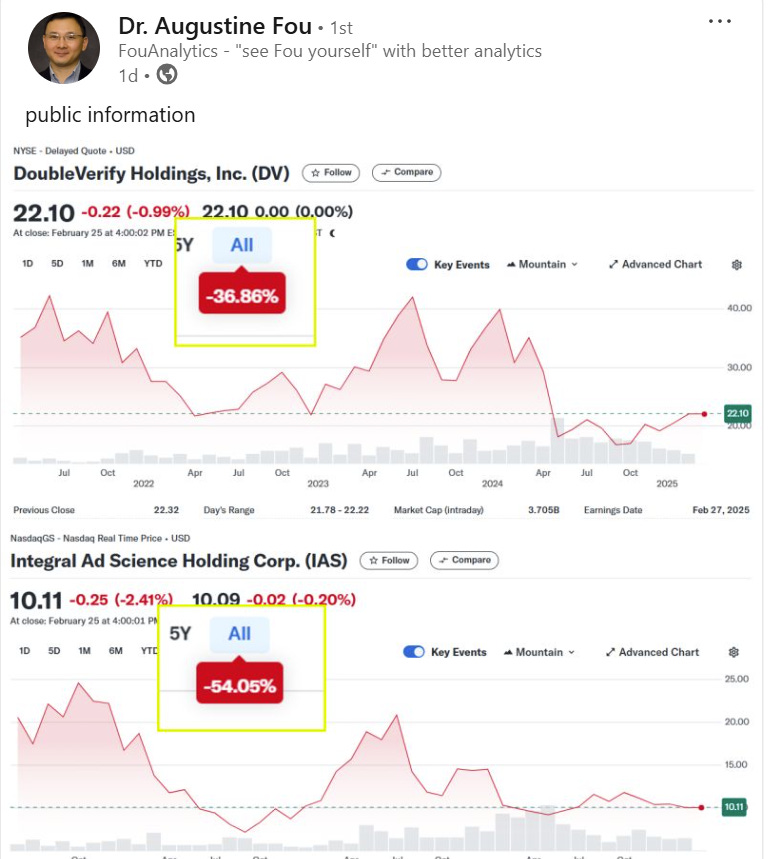

AppLovin was a meteoric gainer since 2023.

It went up more than 36x!

It was one of the biggest conversion sources in Google Play’s ecosystem for years, but almost no one knew what AppLovin was.

Those insiders and early investors made plenty of money.

But it was all based on fraud.

More and more evidence of fraudulent2 advertising behavior has been released over the last year.

Many of the big financial firms *Still* maintain a buy rating on this stock. They can’t accurately change it. Because to admit they recommended a well-oiled rip-off would blacken their reputation.

In this post, we’ll cover:

What we know about AppLovin

The business model

What short sellers’ new claims are

Data Theft from Meta

Direct Downloads

Tracking Children

How to avoid fraud and scams like AppLovin in the future

Marketing fundamentals

Incrementality testing

Healthy skepticism

AppLovin—A Big Winner of 2024

In 2024, AppLovin’s stock APP 0.00%↑ skyrocketed.

Investors celebrated this meteoric rise, driven by the company’s AI-powered advertising platform, AXON 2.0, which promised to revolutionize mobile advertising.

But they flew too close to the sun.

As of Feb 26th, 2025 short-seller reports from short sellers Fuzzy Panda Research and Culper Research have raised alarming allegations of ad fraud, data theft, and unethical practices.

If these claims hold true, AppLovin’s valuation could plummet like the many other (questionably valid) covid-era AdTech firms, leaving marketers questioning whether their ad budgets are fueling a profitable illusion rather than real results.

AppLovin markets itself as an ad-tech leader, using artificial intelligence to optimize ad placements, primarily in mobile gaming, with a recent push into e-commerce.

But short-seller reports suggest that this growth may be built on deceptive tactics, echoing broader concerns about ad fraud—an issue costing marketers over $100 billion annually.

What Does AppLovin Do?

AppLovin operates as a mobile ad-tech platform, connecting advertisers with app users through its AXON 2.0 technology.

Their business model is pretty simple:

Core Function: It “uses AI”3 to match advertisers with publishers, focusing heavily on mobile gaming but expanding into e-commerce. The platform optimizes ad placements to boost app installs and user engagement.

Mechanism: Advertisers pay for outcomes like cost-per-install (CPI) or cost-per-action (CPA), while AppLovin earns commissions by facilitating these transactions via real-time ad auctions.

Performance: In 2024, the company reported significant revenue growth, attributed to AXON 2.0’s efficiency, propelling its stock to new heights.

While the numbers dazzle, the allegations suggest that this success might stem from manipulation rather than solid fundamental business practices.

In this post, we’ll cover each of the claims and what a healthy level of skepticism should be from marketers.

The Short-Seller Allegations: Unpacking the Claims

Fuzzy Panda Research and Culper Research have leveled serious accusations against AppLovin, backed by investigations involving former employees, code analysis, and user data.

These claims align with other research that reached similar conclusions.

While short sellers profit from stock drops, the code analysis and user reports make this claim hard to dismiss. See footnotes for a healthy level of skepticism on these reports.

Here’s what they allege4:

Ad Fraud Tactics:

Claim: AppLovin inflates metrics with fake clicks and installs, using manipulative ad designs like unclosable “X” buttons that trigger downloads or hijacking normal motions to bring you to the app store.

Evidence: Click-through rates of 30-40%—10x industry norms—were flagged as fraudulent by experts. Code analysis showed ads auto-clicking or opening app stores, corroborated by user experiences.

My Assessment: Almost certainly true. The low-quality segment AppLovin targets is ripe for abuse and hard-to-track conversions. We see screen recordings of this repeated across sources.

Implication: This mirrors classic ad fraud, undermining trust in reported performance.

Data Theft from Meta:

Claim: AppLovin allegedly “steals” Meta’s targeting data to power its e-commerce expansion. It requires e-commerce clients to spend $600,000 monthly on Meta ads and use the same ads on AppLovin’s platform, allowing it to reverse-engineer Meta’s successful ad strategies.

Evidence: A confidential study cited by Fuzzy Panda found a correlation between AppLovin’s and Meta’s e-commerce targeting exceeding 12.7 standard deviations—statistically improbable without data misuse. Experts and e-commerce founders noted synchronized performance dips between the two platforms.

My Assessment: Probably true. This could be contaminated by the test focusing on similar market segments between Meta and AppLovin. Meta is a gold standard, so they could have a similar model--but the most likely answer is data theft.

Implication: If Meta confirms this, it could shut down AppLovin’s access, collapsing its e-commerce ambitions.

Policy Violations via “Direct Downloads”:

Claim: AppLovin reportedly uses “direct download” tactics to install apps without user consent, violating Apple and Google app store policies. Culper Research uncovered code enabling this, tied to partnerships with carriers like T-Mobile and OEMs like Samsung.

Evidence: Former employees boasted on LinkedIn that “direct downloads” are a “top revenue driver,” with spikes in app installs correlating with new partnerships in regions like Brazil and India. User complaints of unsolicited installs further support this.

My Assessment: Probably true. This is a common feature of ad fraud across platforms. Would reduce stock price and business confidence, but is not an unusual practice.

Implication: Such practices could lead to AppLovin’s SDKs or apps being banned from app stores, crippling its business.

Privacy Breaches and Tracking Children:

Claim: AppLovin allegedly tracks users, including children, without consent, using fingerprinting techniques and serving inappropriate ads (e.g., sexual content) to minors.

Evidence: Tests on children’s devices revealed explicit ads and a unique identifier persisting across apps, even on “Do Not Track” accounts. An older SDK showed collection of 50 data attributes, enhanced by third-party data brokers.

My Assessment: Very likely true. This is the biggest legal concern for AppLovin. If true, this would mean ban from many sofitware partners, platforms, and an immediate stop to many core business functions.

Implication: This violates laws like COPPA, risking hefty fines and app store bans.

The company denies the allegations, but the mounting evidence has added flames to a growing fire.

Analyzing AppLovin’s Business Model

Using a marketing fundamentals lens, let’s evaluate AppLovin’s operations:

Value Proposition: AppLovin promises efficient ad spend—more installs and conversions for less cost. This aligns with the principle of maximizing behavior change (e.g., app usage) for minimal investment.

Market: It dominates mobile gaming, a lucrative space, and targets e-commerce, a high-growth vertical. However, it faces stiff competition from Meta and Google.

Profit Model: Revenue comes from fees on ad placements (CPI/CPA). If installs are fake, as alleged, this model generates revenue without real user engagement.

Costs: Significant investments in AXON 2.0 development and client acquisition could soon be dwarfed by legal and regulatory expenses if allegations are substantiated.

Critique: True marketing success drives authentic behavior change, not gamified top-of-funnel stats.

Frankly, even if AppLovin doesn’t rely on fraud, it’s creating a mirage of impact—low-intent clicks and installs don’t translate to revenue.

Key performance indicators (KPIs) should reflect down-funnel outcomes (e.g., purchases), not just top-of-funnel vanity metrics.

Lessons from Ad Fraud Trends

Ad fraud is a pervasive issue, siphoning over $100 billion yearly by faking metrics like impressions and installs. Marketers see impressive dashboards, but conversions lag because the “users” are bots or coerced installs. AppLovin’s alleged tactics—fake clicks, direct downloads, and data theft—fit this pattern perfectly.

The takeaway?

Focus on outcomes (revenue, retention) over optics (clicks, installs). AppLovin’s story underscores how easy it is to fake top-of-funnel success and how hard it is to detect without scrutiny.

Could AppLovin Hit Zero?

The risks are stark:

Regulatory Hammer: Proven violations of app store policies or privacy laws (e.g., COPPA) could lead to bans, cutting off AppLovin’s access to 99% of the mobile market.

Competitor Retaliation: If Meta confirms data theft, it could block AppLovin’s access to its ecosystem, gutting the e-commerce push.

Trust Collapse: Advertisers fleeing a fraud-tainted platform would slash revenue overnight.

A stock that hit $500 could crash to nothing if these dominoes fall. For marketers, this isn’t just AppLovin’s mess—it’s a warning: your campaigns might be built on lies too.

And this isn’t without precedent! You don’t hear much about APPS 0.00%↑ anymore, even though it was a similar wall street darling in 2021.

How Should Marketer’s React?

Audit Your Partners.

Scrutinize sudden spikes in clicks or installs—do they lead to real sales?

Run an incrementality test to make sure your vendors aren’t taking advantage of metrics on conversions that already would have happened

Ask ad partners for detailed breakdowns of targeting methods and data sources.

Make sure you’re getting something when you pay.

Think Twice Before Adding Rising Stars

Marketing fundamentals are pretty boring.

Even with exciting new technology, fundamentals reign supreme.

Slow, steady investment and response to customer preferences leads to a successful business.

But everyone wants to win quickly and big. Be skeptical of anyone promising overnight success or 10x business.

Track Important Numbers

Prioritize meaningful outcomes over flashy stats.

Until it’s money in the bank, it’s not real.

Conclusion

AppLovin’s stock soared on promises of AI-driven ad success, but allegations of fraud and unethical practices threaten it.

For marketers, this is a wake-up call: (as always) prioritize real outcomes over flashy metrics, audit your ad partners, and stay skeptical of too-good-to-be-true results.

And ad fraud researchers

Most of the claims I consider true allege fraudulent behavior, but not necessarily illegal behavior. That remains to be seen.

Not only do I not ever believe a company actually uses AI until proven, but also this is a core claim from Fuzzy Pandas.

What’s Healthy Skepticism of Short-Seller Reports?

When reviewing the short-seller reports from Fuzzy Panda Research and Culper Research about AppLovin, it’s important to be skeptical for a few key reasons.

Financial Motivation:

The firms behind these reports hold short positions in AppLovin, meaning they stand to profit if the company’s stock price declines. This creates a clear conflict of interest. While their research might include detailed analysis, their financial incentive could lead them to emphasize negative findings, exaggerate issues, or omit positive aspects that don’t align with their investment thesis. Readers should consider that the primary goal of these reports may be to drive down the stock price rather than to provide a balanced assessment.

Conversational Tone:

Unlike traditional financial reports, which typically use dry, technical language, these short-seller reports are written in a conversational and sometimes sensational style. For example, they include lots of highlighted screenshots and red boxes—useful, but potentially salacious.

This approach makes them more engaging and accessible to a broader audience, but it raises questions about their intent.

Are they aiming for accuracy and objectivity, or are they trying to persuade the public by leveraging emotive language and dramatic framing? This departure from conventional financial analysis suggests a strategic effort to influence perception, which could compromise their credibility.

These factors don’t automatically invalidate the reports, but they do mean readers should critically evaluate the information rather than accept it at face value.

The short-seller reports should be viewed with caution due to the firms’ financial motivations and their conversational, potentially persuasive tone. These elements suggest a bias toward painting AppLovin in a negative light.

That said, the allegations aren’t baseless—many are backed by substantial evidence, particularly the claims around policy violations and ad fraud, which I think are likely true based on the code analysis, user reports, and industry patterns. The data theft and privacy breach claims are also plausible, though they’d benefit from more transparent evidence like the full statistical study or detailed testing protocols.

In short, while skepticism is warranted, the seriousness of the accusations and the supporting data mean they can’t be dismissed outright.

You should weigh the short-sellers’ incentives against the strength of the evidence and approach the situation with both critical thinking and an open mind.