How Financialization Broke Commerce and Marketing

Why mimicking what successful marketers did before won’t work for you

Author’s Note: Crazily enough, I outlined and almost completed this article before any of the most recent retaliatory tariffs were announced. The point still stands, and tariffs are a convenient backdrop to the article

Increased financialization has grossly deformed U.S. commerce by prioritizing speculative growth over sustainable value creation.

Marketing has been disproportionately affected. It was vulnerable because it’s feedback loop is more sensitive and less clear.

Generations of marketers have now become used to a workforce dictated by artificial forces rather than natural laws.

Generations of marketers believe lies.

As macroeconomic forces return to a more natural equilibrium, marketers will have to start farming from derelict fields they abandoned years ago.

How did we become so wrong?

For the last 50 years, we’ve lost the collective feedback loop where good behavior was met with financial reward.

Build a business to serve a customer? You should become rich

But building a business is hard.

What if you could get the same financial reward without any of the hard work?

America became addicted to financial sleight-of-hand

Children have grown up dreaming of starting a unicorn startup1 or running a hedge fund.

They’re not looking to run a successful car dealership.

They’re not just looking to win big; they’re looking to win big & fast.

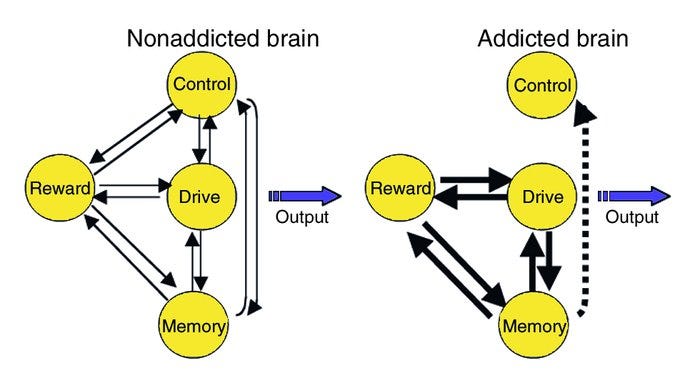

The financial sector has the attributes of an addicted decision making process

They’ll rip the copper wires out of a working building to make a quick buck—at the expense of breaking the entire system in the process.

Instead of running a profitable business, they’ll rip and sell whatever can make a quick dollar.

This trend is visible in America by tracking the decline of ‘primary’ and ‘secondary’ businesses (mining and manufacturing) and the increase of ‘tertiarization’ (email & spreadsheet jobs).2

Common Mechanisms of Deformation:

The financial sector’s focus on shareholder value (e.g., stock buybacks, mergers) over reinvestment in production or labor, as seen in manufacturing’s decline.

The rise of private equity (PE) and venture capital (VC), which prioritize short-term exits (IPOs, acquisitions) over long-term sustainability, as discussed in this great New Yorker article.

Complicated debt instrumentation, debt swaps, and financial tooling in ZIRP environments providing more free cash than any business naturally should produce.

Businesses get out of whack.

Resources get misallocated: Capital flows to speculative tech startups (e.g., WeWork, Humane AI) rather than productive sectors like manufacturing.

Wage gains are extremely uneven: The top 1% capture wealth, while workers in declining industries like manufacturing face job losses and wage stagnation.

Marketing’s Disproportionate Distortion

Marketing is the canary in the coalmine. It’s fragile, complicated breathing organs show signs of failure before bigger objects feel anything at all.

It’s ability to quickly react means that marketing teams can spin up new campaigns in weeks (vs factories retooling over decades). But it’s speed is also it’s downfall.

As new demands are added onto the marketing feedback loop, they’re able to shift the output very quickly.

Pre-financialization, marketing was about sales—David Ogilvy hammered home the power of informative ads that actually persuaded.

But post-1970s, as manufacturing tanked and finance swelled, marketing morphed into a circus act to dazzle investors, especially in tech. Then came the GFC and ZIRP (2008 onward): VC cash exploded from $27 billion in 2008 to $130 billion by 2021 and marketing became a growth signal for VCs, not a driver of sustainable revenue.

We’re not selling to end-customers anymore—we’re performing for those with the checkbooks.

Marketing’s distortion isn’t just collateral damage—it’s the front line of this deformation.

A Generation of Marketers Misled

A mature generation of marketers, forged in the post-1970s financialized economy, has learned to imitate the grasshopper—chasing optics like viral campaigns and digital growth metrics over the substance of sales and customer loyalty.

They’ve swapped the ant’s work ethic for the fox’s golden carriage.

This isn’t just a shift; it’s a reversal of what marketing should be.

Cultural Shift in Marketing

These marketers now prioritize investor appeal over customer needs.

Today’s marketers craft campaigns to wow VCs, not serve buyers.

Look at Humane AI: they poured $230 million into an AI Pin, designing it to look VC-friendly—sleek, Apple-esque—while ignoring usability.

The result? A measly $9 million in lifetime sales, with returns outpacing sales . It’s a flop born from chasing the wrong audience—from trying to aim for the same results without understanding the internal processes. .

Marketers act like Clever Hans, mimicking successful outputs like Apple’s polished products without grasping the inputs—deep user research, iterative design.

That’s why the AI Pin crashed; it was a Clever Hans act, all show and no substance.

Consequences

This generation clings to “entirely wrong ideas”:

that growth metrics, especially on digital platforms, equal success

that marketing’s job is to impress VCs, not drive sales

that making campaigns that the media likes means customer insight

that mindlessly feeding the Google box leads to success

It’s a delusion peddled by likes and retweets, not revenue.

This disconnect from fundamentals fuels business failures: Humane AI’s $9 million haul against $230 million raised is a glaring red flag, and the 2023 Silicon Valley Bank collapse—tied to overexposure to tech hype—shows how this instability ripples outward, breaking the system we rely on.

Societal Impact

Marketing’s obsession with optics doesn’t just hurt businesses—it hurts everyone else.

Gig economy giants like Uber (from the New Yorker article) polish their image with slick ads, masking exploitative labor practices3 to keep drivers & investors hooked.

Workers get squeezed while suits cash out.

Marketers, especially through pricing tactics and lobbying to government, have colluded with businesses to force textile goods’ prices below the cost of their natural externalities.

With offshoring, they’ve unleashed a flood of low-quality waste—cheap T-shirts that fall apart after one wash—and guzzled insane amounts of clean water to churn out this garbage.

If they were forced to react to the natural results of these actions (unhappy customers, American businesses unable to fill orders at that price), then they’d never create the culture of waste we currently have.4

We’ve built a legacy where the grasshopper’s fiddle drowns out the ant’s warning—“What will the next generations grow?”—and the answer’s looking grim unless we rip off the blinders.

Reimagining Commerce and Marketing—Lessons from the Ant

We’ve been drunk on the free money fiddle for too long, and it’s time to sober up and learn from the ant’s diligence.

The Ant’s Wisdom

We need a hard pivot back to business fundamentals in commerce and marketing. Forget the speculative growth that gutted pensions and manufacturing and start focusing on real-work.

Revive marketing with real investment, not just hype.

Marketing should ditch the media-optics chase and zero in on sales effectiveness and customer value—stuff that actually keeps a business alive, not just looking good for VCs.

Policy and Business Solutions

Marketing needs its own overhaul: shift metrics back to sales and customer retention, not just ‘growth’ numbers that brag about how quickly you’re loosing money to buy social media ads and conferences.

Train marketers to prioritize substance—look at Apple’s user research obsession as the gold standard—over empty promises.

And keep the playing field fair: prosecute securities fraud from marketers who lie publicly about their companies.

Cultural Shift

The next generation of marketers can’t grow up idolizing the grasshopper’s shortcut dreams.

We’ve got to educate them to reject that flashy nonsense and embrace the a focus on sustainability and fundamentals.

Teach them that a successful, day over day brand marketing beats a unicorn viral campaign5 any day.

Culture shifts start with us—show them companies like Coca-Cola and P&G.

They’ve been doing long-term brand marketing for decades. They’re so entrenched that their products are kings across departments.

They do their research. They pick the right (unsexy) medium. They make good brand ads. They’re kings of fundamentals.

The ant’s legacy isn’t about quick wins; it’s about leaving fields fertile for the kids marketers who come after us.

We’ve got derelict land to reclaim, readers

Picking up the pieces

Increased financialization has left U.S. commerce a twisted shell, prioritizing speculative growth over anything that lasts.

Marketing took the hardest hit. Its fragile feedback loop buckled under artificial forces, leaving generations of marketers chasing lies instead of natural laws.

They’ve imitated the grasshopper, fiddling for vanity metrics and now, as macroeconomic forces creep back to equilibrium, they’re stuck farming derelict land they abandoned decades ago.

How did we get so upside-down? We got hooked on marketing quick wins—viral media, new platforms, “impressions”, anything but the hard work of building a real marketing base.

I offer a way out of the dark: return to the grind of brand marketing, sales-focus, and customer value.

Hold marketers to real metrics, and teach the next generation to reject the shortcuts.

Companies like Coca-Cola and P&G show us the way—kings of fundamentals, playing the long game with unsexy, effective brand marketing that outlasts any viral stunt.

Tech startups are “overly financialized” because their value is often only realized in the form of acquisition from a larger entity.

This environment (with its handsome rewards) deforms the business landscape because startup founders are not incentivized by business fundamentals—they’re incentivized by whatever will get them acquired.

The only two kinds of jobs are those that refine materials from Earth’s bounty and those that service them. If your tooth-to-tail ratio gets too far out of whack, then you’re going to have the tail wagging the dog.

It’s crazy that Salesforce is worth more than all the sp500 mines that produce the physical world around us.

The average person does not understand depreciation or the costs of preemptive maintenance. Pretending that they do is a foolish lie that lets businesses extract from the less intelligent.

There obviously is some level of freedom of commerce that’s reasonable, but Uber is on the very edge.

Kind of. I’m willing to blame marketers only somewhat for the consumerism of America. This is also a separate issue out of the scope of this post.