How To Price A New Product With Value Walks

Don't leave money on the table by pricing lower than you need to

White snow covered the creaking, crackling icy sheets and the rocky shores alike. The white blanket stretched from the boat’s wooden bow to the sharp edge of the horizon.

Unlike the soft stillness that the crew had grown used to, the icebergs’s grinding had seemed to only grow more intense after the storm.

The crew had been on their way back home when the storm dragged them around with a blindfold of driving sleet.

Unfazed by the alien-looking world around him, the captain know how to navigate back home.

He turned from the icy slush and ordered his crew to tie knots in the anchor rode at regular intervals.

He commanded that they drop the anchor.

At the same time he marked his map with their last known point before the storm. He waited to hear how quickly the knots slid out of the boat.

He planned to measure their latitude against the stars that night. He’d compare the knot’s speed to track their distance from the location before the storm.

By measuring the speeds and directions they sailed, he would keep track of where they actually are.

The captain set his jaw and the boat’s direction towards what he hoped was home.

How Do Vikings Affect Modern Business?

All of us find ourselves in situations where navigational information is limited.

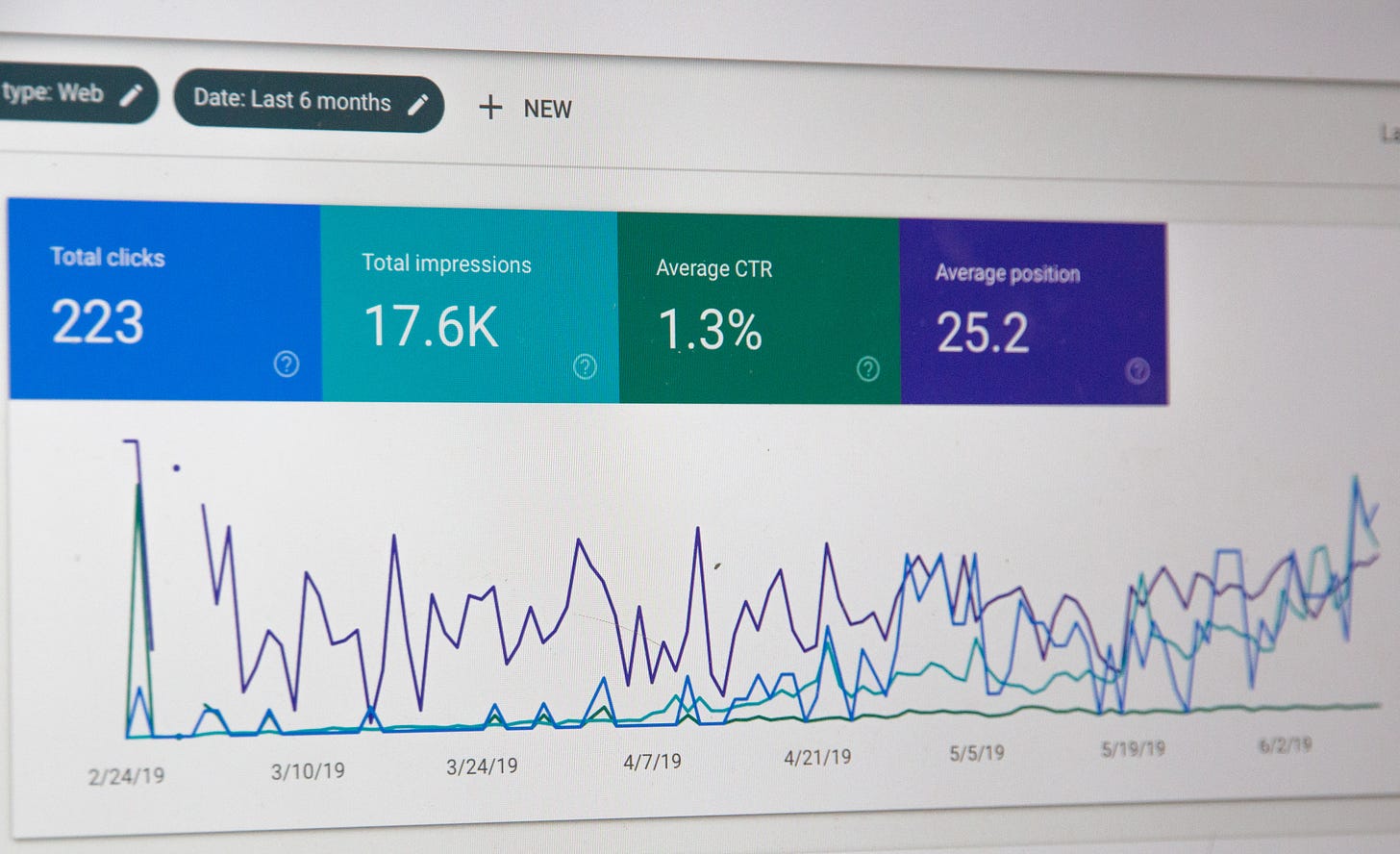

Imagine an unlucky marketing operations manager. This manager inherited a digital analytics program entirely based on Google Analytics 3 (GA3) properties.

In June this year, GA3 data flows simply stopped.

Her team worked quickly and rebuilt new Google Analytics 4 data streams. But how does she know if the new metrics mean she’s off course?

What if it’s just a new way of measuring the same thing?

Like the captain above, this unlucky soul has to use “Dead Reckoning” and compare relative numbers against a starting point.

Good thing she knows exactly what to do.

After a few days of using the new system in GA4, she’s cataloged the common values in the new system.

She’s associated new values with her KPIs and has a new baseline. Through digital dead reckoning, she can tell if a campaign reaches its intended result.

Pricing: Often Hard to Navigate

You need to get to the price right before anything else.

-Ed Wollard

When most lay people think of pricing a new item1, they generally add up the costs to produce that item. They’ll add the materials cost, the labor cost, the shipping cost, etc.

Once they’ve added everything, they add a known profit margin on top, and call it a day.

This is the pricing version of driving from Miami, Florida to Cancún, Mexico by marking out each leg of the journey before starting.

Yes, you will get to your destination by pre-planning your drive.

Yes, you’re less likely to get lost on the road than on the ocean

What if you sailed instead?

Yes, sailing means that you have to make on-the-fly adjustments

Yes, you could get lost more easily

But sailing could lead to your destination more quickly.

While the practice of using only known cost inputs to set price—cost-based pricing—will give you a workable result in a vacuum, it often misses the mark.

Cost-based pricing completely neglects that different audiences place different values on your product and would punish innovation that improves efficiency by reducing the gross revenue of a less-expensive manufacturing process.

So what else could we do to find a market price?

Value-Based Pricing With Value Walks

A common, often better alternative to cost-based pricing is Value-Based Pricing, where price is set by the value given to a end customer.2

To find what the value to a customer would be, Ed Wollard talks us through a method called “Value Walks”.3

Check out more from Ed on the importance of Pricing in this previous post

The Price is Right--Until It's Not

Recently, I interviewed Ed Wollard, a Product Marketing Manager at Honeywell, a Fortune 100 company.

Ed argues that Promotion’s popularity is ill-deserved and Pricing is actually the core sink-or-swim factor in a purchase.

Ed: The common way I've seen it done is by using the Next Best Alternative.

So let’s say I have Product A, and the Next Best Alternative is Product B.

Product B sells for $55.

Now I’ve got to look at the features of my product, why my product is better, or what different value I provide to the customer [compared to Product B].

For example, superior customer service could be a big value to the customer.

I’ll think of all the features that differ and I’ll put a dollar value to each of those differences.

And there might even be some negative values too.

And then at the end, you give the customer some discount.

If selling my product at $65 is the same as buying that other one at $55, I might give them a $5 discount [to capture more market share].

Therefore the customer receives a $5 extra value of buying mine over [Product B].

Many people want to think that if my part is better, I could get a better price.

More often, if my part is better at the same price I'll win.

You need to get to the price right before anything else.

Conclusion

It’s important to ensure that your pricing strategy aligns with your company goals.

For some companies, the customer’s feeling of getting a good deal is more important than making a single sale.

For others, a customer wants a good not everyone can afford.

Now that we’ve discussed two pricing practices, ensure your end pricing aligns with your overall company goal.

A company should align advertising to the brand image. Pricing should reflect the same prioritization.

Good luck pricing!

Myself included when Ed turned the interview around and quizzed me on the spot about how I would price something.

This is the same concept often used to calculate taxes in Europe called Value Added Tax

Note that I said that we could find the value to “a customer” instead of “customers”. Each customer segment’s value would need to be calculated because each customer segment cares about different things.

An enterprise-scale business might care more about 24/7 tech support than a mom-and-pop ecommerce business even at a higher end cost.

Beyond pricing for maximal profit, understanding the different elements of the value walk for that customer can help improve the product offerings in the future.

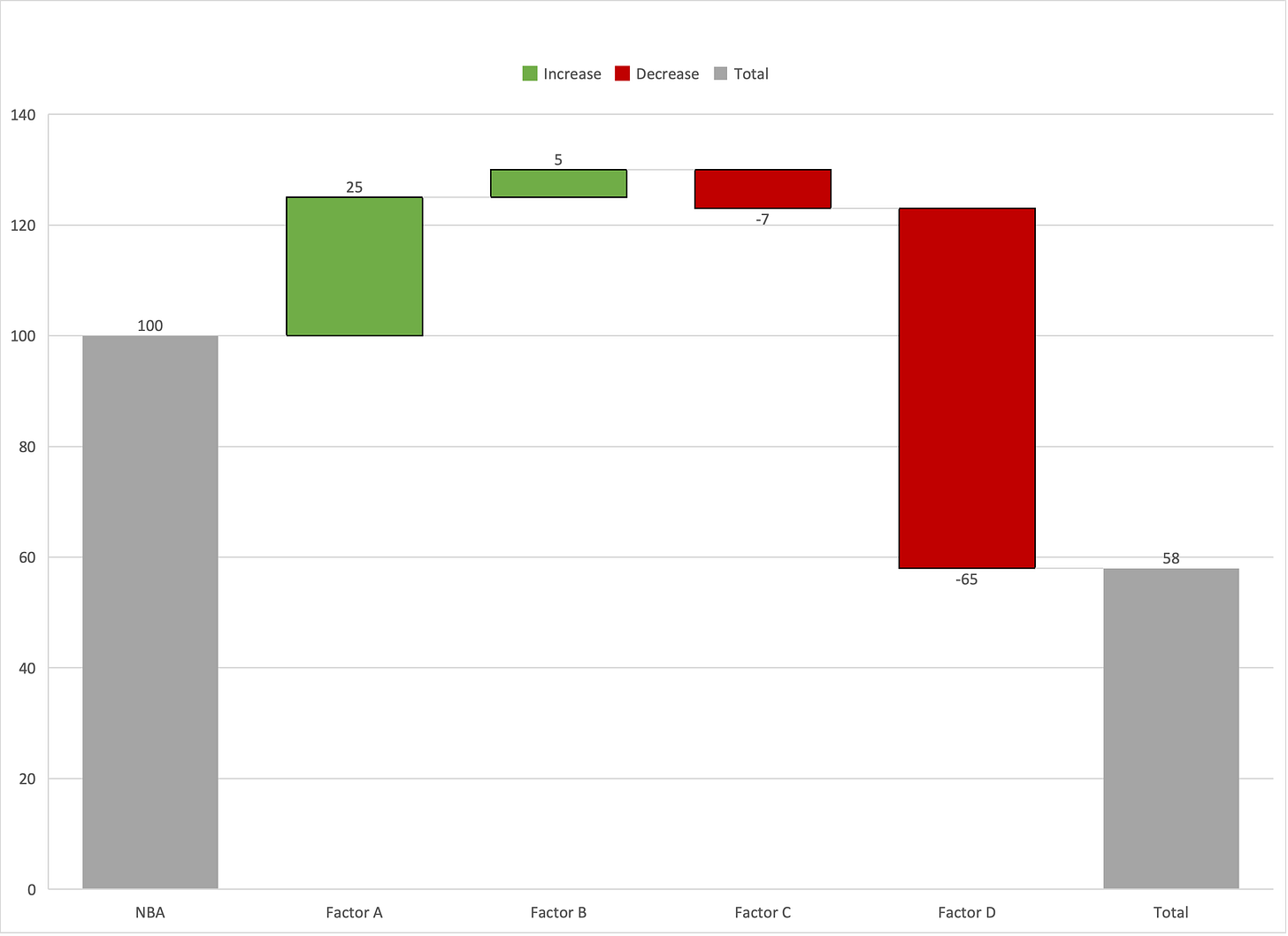

For example, if your value walk looks like the above image, reducing the negative impact of Factor D by 10% is more important for your overall product value than increasing your differentiated Factor A by 20%.